NETWORK BRANDS ERODED BY STREAMING VIDEO

As volatile as the TV industry has been lately, the one segment that has been relatively stable– and consistently profitable– is network broadcasting. This may be about to change.

With the release of new video interfaces such as the most recent upgrade of Comcast X1, and with the launch of multichannel live TV streaming platforms such as Sling TV, DirecTV Now, and Hulu Live TV, the most prominent broadcast networks finally have reason to fear possible extinction. They’re losing their ability to keep their brands in the public eye.

Investment Bankers Weigh In

Kannan Ventakeshwar, an investment analyst for Barclay’s, a multinational British bank, wrote a letter about the TV industry’s future to investors. In it he stated: “Every OTT product is organizing its default user interface by the type of content and not by network. So sports does not show up as ESPN or YES Network. Instead, the default interface is organized by sport and/or teams. This is also becoming true with legacy user interfaces like X1. As a result, it is tough to see the brands of individual networks retaining value in the coming years.”

Until recently, the program guides for cable and satellite TV listed channels under assigned numbers. It was only by looking up particular channels that the viewer could see what shows were airing on those channels at what times.

Viewers Want Convenience

Ventakeshwar said, though, that viewers are losing patience with this system. “…In every evolution of OTT”, he said, “the number of clicks needed to get to a program guide or a network viewing option is actually increasing. Given the importance of consumer inertia in usage patterns, this is not a trivial shift.”

In other words, the harder it is for the viewer to find the shows he wants, the

more likely he is to tune out altogether.

Listing by genre or title saves time, but reduces visibility of network brands. This threatens the network business model. Under the old model, new shows are far more likely to succeed if they immediately precede or follow established hits. A highly popular show might even carry an entire evening’s lineup. A ‘halo’ effect– the network’s reputation for airing shows the viewer likes- can induce him to try out its newer shows.

No More ‘Halo’ Effect

If video interfaces are no longer listing shows by channel, though, the lead-in.

lead-out, and halo effects nearly disappear. Each show is an orphan, standing or falling on its own, and offering little market support to other network programming.

Some streaming platforms, such as Amazon Prime Video, Netflix, and Hulu, further undermine network brands by offering their own original content. And you can find their content only on their own platforms. If you want a Netflix original, you’ll find it only through Netflix.

How can the networks adapt to these developments? We don’t know, but they haven’t yet. Perhaps they never will.

If they can’t figure out how to protect their brands, the giant broadcast networks may be headed for extinction. Productions studios could live or die by their latest hits.

Notes:

Comcast owns NBC Universal, the largest and oldest broadcast TV network.

With its updated X1 interface, then, the cable system is partially cannibalizing its own business.

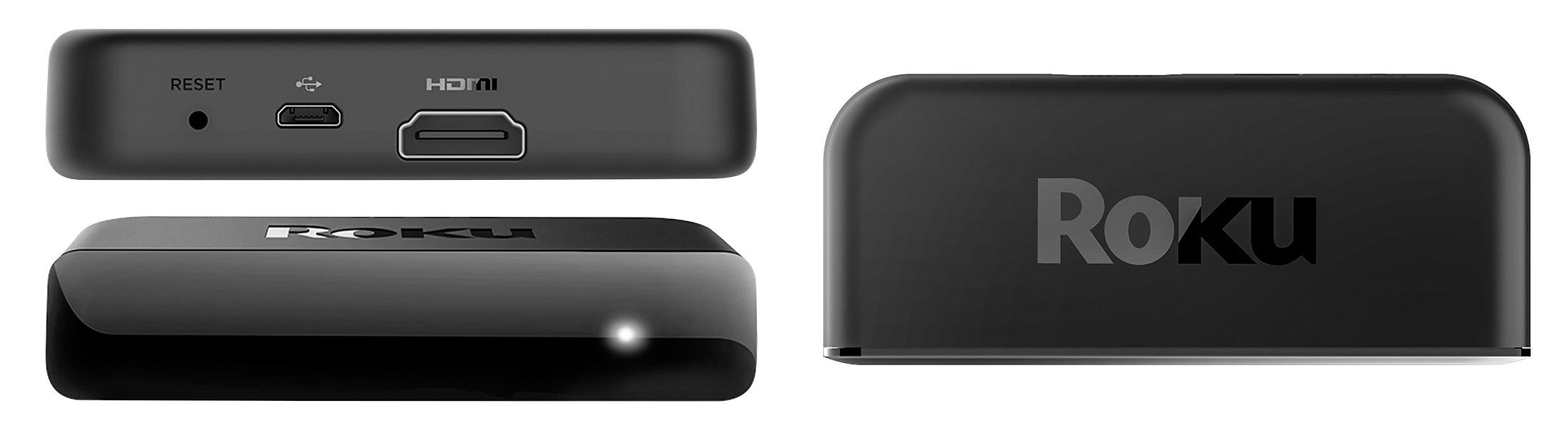

OTT is ‘over-the-top’ video. It is content streamed via the internet as a standalone service. With OTT, no cable or satellite system controls or distributes the content.

(For streaming video, you need a strong internet connection. Is yours adequate? If it isn’t, talk to us. We can help.)